Accounting Technology Welcome to Central Ohio Technical College

The explosion in data that has launched the Fourth Industrial Revolution, an era when business will be transformed by cyber-physical systems, has enabled several technology trends to develop. Every business can leverage these important trends and should pay attention to how best to use them, but accountants should really evaluate how these six technologies can be used strategically to achieve the company’s business strategy. In recent years, trends in advanced technology have transformed the ways in which accountants work. By automating workflow processes with connected Accounting technology, the challenges of paper-based processes and tedious manual work are a thing of the past. With today’s accounting technology in place, accountants can shift their focus from tedious tasks to more value-added work.

- With remote working, new ever-changing government schemes and support packages, and geopolitical issues like Brexit, clients have turned to their accountants for guidance.

- Now that we know more about accounting technology, we can explore some of the specific ways that it’s changing.

- In driving the adoption of new technologies, for example, it was the accounting profession that first used adding machines (specifically for use in tax calculations), which ultimately were precursors to the computer.

- Accounting technology offers accountants the ability to share data and documents with clients and staff in real time.

- Next, you have to ask yourself whether you want access to the transactions you have stored in online financial accounts (checking, credit cards, and so on).

- Especially in the financial sector, blockchain technology has the potential to transform entire industries.

After you’ve supplied information about your company structure, one of your next setup tasks will be to add information about your customers and vendors. Some online accounting software lets you include more than basic contact details (“customer since” date, birthday, and other similar fields), which can be helpful as you develop and maintain relationships with them. You do the same thing for the products and services you sell, so you can add them easily to transactions.

Product & service classification

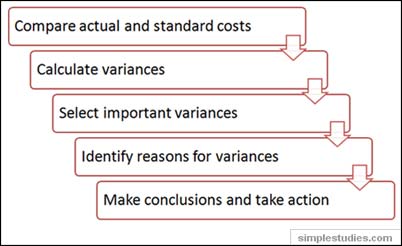

One of the major impacts of technology on the accounting profession is its ability to streamline workflows, improving efficiency and productivity. Automating accounting processes removes manual tasks, like handling large volumes of data, to help accountants manage a more significant workload by focusing on higher-thinking tasks. When it comes to selecting the right technology for your firm, it can be challenging to understand all the different options. Research shows that accounting firms are investing in technology like advanced and predictive analytics (21%), automation including RPA (20%), and Artificial Intelligence (20%). By embracing accounting technology, accounting firms can unlock significant advantages and gain a competitive advantage — making digital transformation one of the driving factors for the evolution of the accounting profession.

In terms of accounting in the cloud, business leaders can look to integrate cloud-based accounting software within their operations. By doing so, they can make financial data accessible at all times, from any location, fostering increased efficiency and collaboration across time zones and anywhere they might be in the world. Today, thanks to advanced accounting systems that interface with businesses in real time, auditors can have access to figures, policies and judgment calls at all times. It allows financial information to be delivered faster, more accurately and in a more trustworthy manner, which signals a key change in how business, and decision making within that context, can be conducted today. In accounting firms, APIs can increase efficiency and reduce redundancy by enabling disparate systems to work together to compare data sets.

Artificial Intelligence and Machine Learning

Automation and other data-driven technologies are poised to free accountants, not constrain them. Organizations that understand the potential and importance of these technologies — and invest in the tools and training required to help their accountants take full advantage — will be ahead of the curve. Tomorrow’s accountants will play a more creative and strategic role in their companies. As a result, their businesses will not only enjoy more efficient workflows and reap more useful insights from their accounting processes, but help strengthen their own resiliency, agility and competitive footing.

You’ll be able to get tasks done faster, reducing the number of long hours you have to spend in the office at financial year-end. In fact, this saved time can help businesses improve efficiency by up to 80%, and can earn a return on investment of up to 366%. Meanwhile, 15% of our respondents highlighted that the use of technology has improved their productivity. While much of your daily accounting work probably involves paying bills, sending invoices, and recording payments, you also need to keep a close eye on your bank and credit card activity. If you have connected your financial accounts to your accounting service, then this is easy to accomplish. You can also view each account’s online register, which contains transactions that have cleared your bank and been imported into your accounting solution (along with those you have entered manually).

Associate in Science Degree – Accounting Technology

Wilkie predicts that 5G will increase reliable broadband connectivity in rural and remote areas, shattering geographic barriers and giving accounting teams access to talent and business that were unavailable previously. Richardson expects jobs, the business environment, and technology to change so quickly that an individual’s capacity to acquire more knowledge will be more valued than the knowledge the individual already has. Richardson also foresees technology playing an increasingly important role in worker training and education.

The full promise of blockchain is yet to be fully harnessed, largely due to regulatory ambiguities and its still early stage of adoption. However, the potential of this technology to revolutionize the accounting industry cannot be denied and deserves close monitoring. It’s probably computerized, running on powerful software that tracks every sale and every refund and uses that information to keep tabs on inventory levels.

Big Data and Data Analytics

Technology leaders in accounting discuss digital assets, what CPAs need to know about Web 3.0, and more in this podcast episode with transcript. Hackers are now using bots to identify and attack cybersecurity vulnerabilities on a mass scale. Find out from technology and cybersecurity expert Roman Kepczyk in the latest episode of the Journal of Accountancy podcast. The AICPA Auditing Standards Board’s Technology Working Group has developed a new practice aid that will emphasize how technology should be seen as a key enabler, elevating audit effectiveness and efficiency for the future. An entrepreneur and keynote speaker explains why artificial intelligence can be embraced and appreciated, instead of feared, in this podcast episode with transcript. Many people might not realize that accounting has been revolutionary throughout its history, especially when it comes to driving the adoption of new technologies and adapting to new technologies.

You’ll practice using computer software to accomplish virtually any accounting function, from correcting payroll transactions to calculating depreciation (a decrease in value over time). Your grade will count largely on accuracy and completeness, qualities also important on the job. I’m an entrepreneurial CPA that founded Xen Accounting, a 100% cloud-based accounting firm, in 2013.

There’s no question that digital transformation has radically changed the playing field. Big data has become a rich resource that needs to be tapped to compete effectively. But for businesses ready to leverage the potential of digital tools, this shift is an opportunity, not a threat. From mitigating unprecedented business disruptors to adapting to new operational paradigms, professionals in all industries find themselves dealing with major changes — many of them driven by emerging technologies. In the past, accountants struggled when making the transition to more advanced technologies.

Embracing modern technology unlocks significant benefits for accounting firms, whether it’s finding new, more efficient ways of working or delivering better services to small business owners. Technology allows accountants to achieve more with less, provide outstanding services and help fuel business growth. It can be easy to write off blockchain technology as the latest business buzzword that will pass with time, but accountants don’t have that luxury.

It supports multiple currencies and has a smart selection of features for very small businesses. It doesn’t have a dedicated time-tracking tool, comprehensive mobile access, or inventory management, though. It’s fair to conclude that cloud-based platforms represent the future of accounting. Cloud-powered accounting software has revolutionized the way accountants operate, providing instantaneous access to financial data from any location at any time. This innovation has introduced a period of improved efficiency, adaptability and security, facilitating seamless collaboration between accountants, clients and colleagues across geographical barriers.

Trullion, AI-Powered Accounting Software that automates accounting workflows for CFOs, Controllers & Auditors. This has moved the CFO—and the accounting team, by extension—to a central place in the company boardroom and at the right hand of the CEO in almost every major decision. The complexity and interdependence inherent in international business were demonstrated by the unforeseen global effects of the 2008 subprime mortgage crisis, and this has only gotten even more difficult for a layperson to understand. CEO & cofounder of Trullion, AI-Powered Accounting Software that automates accounting workflows for CFOs, Controllers & Auditors.

Accounting technology trends to keep up with

The best part is that OCR allows accountants to cut hours of work from such tasks as itemizing receipts, organizing invoices, tracking expenses, and eliminating paper clutter. The business landscape is quickly approaching the no-coding era of accounting, which means there will be virtually zero data entry required in the industry. Automated technology has always presented the double-edged sword of convenience against the replacement of humans with technology. In simple terms, blockchain is the distribution and decentralization of database technology. It can protect encrypted data and maintain an expanding list of transactions among all parties involved. Especially in the financial sector, blockchain technology has the potential to transform entire industries.

In addition, we have wealth management advisors in our office to assist with your long-term financial planning and investment decisions. After completion of 500 hours of service, employees are permitted to enroll in our 401(k) Plan and contribute pre-tax dollars. We offer a matching contribution of 25% of all employee contributions, excluding any catch-up contributions, and vest over three years. Once you complete a customer record and start creating invoices, sending statements, and recording billable expenses, you can usually access those historical activities within the record itself. Some accounting programs, such as Zoho Books, display a map of the individual or company’s location and let you create your own fields so you can track additional information that’s important to you.

Tech News: OpenEnvoy guarantees 100% accuracy in data … – Accounting Today

Tech News: OpenEnvoy guarantees 100% accuracy in data ….

Posted: Fri, 18 Aug 2023 15:33:45 GMT [source]

Instant search tools and customizable reports help you track down the smallest details and see overviews of how your business is performing. Android and iOS apps give you access to your finances from your mobile devices. Founded in 2013, Casetext uses advanced AI and machine learning to build technology for legal professionals, creating solutions that help them work more efficiently and provide higher-quality representation to more clients. Casetext’s customers include more than 10,000 law firms and corporate legal departments.

By taking care of the most menial jobs, automation gives you the time and headspace to focus on more pressing things, such as giving clients great service. Robotic process automation will save you time when it comes to boring administration tasks, such as scheduling meetings with clients and filing completed reports. Accounting automation technology will allow processes or procedures to be completed with minimal human assistance.

Lascia un commento