How Does Bitcoin Work As A Hedge Against Inflation?

Contents:

Stocks markets for a very long time, have beaten inflation. The production includes labour costs and materials costs. It limits their future earnings and lowers expected earnings. It might not be easy to evaluate your financial goals and risk profile.

- It might not be easy to evaluate your financial goals and risk profile.

- A firm dollar makes buying gold much more expensive thereby reducing the investment appetite.

- As inflation rises, so do property values, and a landlord can charge a higher rent.

- Avoid these mistakes to ensure the year ahead is a happy one in which you make real progress towards your financial goals.

- Different subcategories in equity funds can suit the requirements of different kinds of investors.

Also in the course of owning a house or real estate, investors will have the opportunity and potential; of increasing its value over time. All-in-all, it is a very lucrative market in which the value of the asset usually only ever appreciates. Bonds or debt funds that invest in bonds are closely linked to the economy’s interest rates, which work in conjunction with inflation rates. Interest rates and bond prices move in different directions.

How the Hindsight Bias Clouds Your Financial Decisions

In dense inflation, detailed information about inflation markets and commercial centers, high demand and limited supply contribute to the appreciation of prices for real estate, which is positive for investors. So, if the price increases are more than the inflation rate, the relative return stays mostly positive. You can outperform inflation with wise savings and smart investments. It is equally important to put your hard-earned savings into work and make them earn money for you. Be abreast of the market, its opportunities, and volatility. Monitoring the movement of individual stocks or the market daily is a difficult task for many investors.

As a result, businesses have started facing the heat with prices of crude oil, raw material etc. on the rise. Inflation-indexed bonds are one of the most secure and effective ways to protect against inflation. Inflation-indexed bonds are one of several types of bonds issued by the government through the RBI. This bond is unique in a way that it adjusts its principal amount to account for changes in inflation, and interest is paid on the adjusted principal.

Top Investments That Are Inflation-Hedges & How To Start Investing

Other alternatives include investing in hedge funds or putting your money into a potential start-up via unlisted shares. Moving on to the stock market’s return, Sensex has delivered a compound annual growth rate of around 15% over the last five years. Cost-push inflation is when price increases due to raised production costs. For example, if the cost of raw materials rises or you pay a higher wage to your labour, the cost of manufacturing the product rises significantly. To cover the increased production costs, businesses raise the product’s price. In metros, the rental yield from residential properties is mostly in the range of 2.5-3 per cent.

When inflation rises, so do property prices and rental income. REITs perform well during inflationary periods because of their ability to raise rents and then pass that income on to shareholders. Every year, the purchasing power of money decreases significantly for different reasons. Due to various reasons, the purchasing power of money decreases significantly every year.

https://1investing.in/ is a cascading long-term socio-economic phenomenon that affects people individually. Various market strategies have developed over time to beat inflation. However, in reality, returns may differ from city to city as the levels of property prices depend a lot on geography. A study by World Gold Council says that for a 1% rise in inflation, there is a 2.6% rise in gold demand, and a surge in demand for almost anything leads to an increase in prices.

Real Estate

Most experts advise that it is good to have around 10% gold in your portfolio. There is no hardcore, upper or lower limit on having gold as an investment. For Indians, in particular, gold has held a special place for centuries. However, beyond its traditional value, gold is also a popular commodity as an investment option.

The Surprising Investment That’s Beating Inflation – and the S&P – GOBankingRates

The Surprising Investment That’s Beating Inflation – and the S&P.

Posted: Mon, 13 Mar 2023 07:00:00 GMT [source]

When the demand increases, it leads to a potential increase in Bitcoin’s value that can beat inflation. Asian Paints Ltd is a perfect example of a company with strong financial indicators that can increase its price in line with the inflation rate. Back in Jan 1999, its share price was INR 11.88, and currently, it stands at INR 2,775, experiencing a CAGR of 26.7%. In the same period, India’s average annual inflation rate is 12.5%. The inflation rates have been rising globally since the end of 2021.

BoB Surges 5% As Business Surpasses Rs 21 Trillion Milestone in Q4

Delta, for example, has not regularly made money from its refinery in the years since it was purchased, limiting its inflation hedge’s effectiveness. When the rupee loses value due to inflation, gold, for example, tends to become more expensive. As a result, a gold owner is protected against a collapsing currency since, as inflation rises and the rupee’s value erodes, the cost of each ounce of gold in the rupee rises. As a result, the investor gets compensated for the inflation by receiving more rupees per ounce of gold.

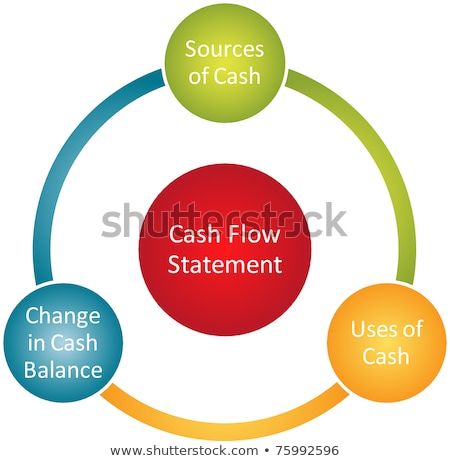

It may cover paying to operate a business, dividend payments, cash outflow etc. So if disbursements are more than revenues, then cash flow of an entity is negative, and may indicate possible insolvency. If an unexpected event occurs, the emergency reserve will assist you in dealing with it. If you have not yet started this emergency fund and a medical emergency arises, you can seek assistance from medical insurance or a personal loan.

Temasek’s acquisition of Manipal Hospital — three big takeaways from the largest PE deal in Indian healthcare

If you look at the returns gold has given in the last 10 years, it is phenomenal. The yellow metal has appreciated by 134 per cent in the last decade. On January 1, 2010, gold was being sold at the rate of Rs 16,650 per 10 grams. The value of the same on September 7, 2019, touched Rs 40,280.

Alternative Investments: Definition and Examples – GVS – United … – Global Village space

Alternative Investments: Definition and Examples – GVS – United ….

Posted: Tue, 11 Apr 2023 04:59:39 GMT [source]

But, for your reference, below are some well-known rules for diversifying your portfolio. An alternative to investing in physical real estate is to invest in Real Estate Investment Trusts . REITs own or finance properties such as offices, warehouses, and hospitals. REITs’ average annual returns in India are between 7 to 8%. A rise in inflation increases the cost of construction materials, impacting the overall real estate price.

- Two sectors that investors often go to are utilities and materials.

- The consumer price index is the most used in the United States.

- However, economists may also use the producer’s price index and personal consumption expenditures price index.

- Hedging against inflation has its limitations and might be risky at times.

In this case, Real Estate Investment Trust is the best option . The growing population is always a source of concern for the economy. Demand push inflation occurs when businesses fail to increase production to meet the current demand for goods and services.

For the prospects of your wealth, this is good news indeed. Any wealth creation strategy requires realistic assumptions on inflation expectations. It serves as the hurdle rate for the portfolio returns to cross, in order to preserve wealth.

While the market has reacted negatively to this, for now, the long term impact on investor wealth is unclear. It’s definitely something we will keep our eye on and see how it all pans out. According to a survey by ET, business leaders of India Inc are bullish about a pick-up in private investment. This combined with a PMI of 55.5 in December reflects well on the prospects of India Inc.

Lascia un commento