QuickBooks Payroll Powered By Intuit Payroll

Content

You can calculate wages for hourly wage earners, freelancers, and salaried employees. You can use Intuit Online Payroll paycheck calculators that will help to see the probable changes in the salaries or hourly pay rates for a single time. No matter if you do not own a business still you can use the payroll calculator to see the impact of the changes on your paycheck.

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. H&R Block, Bankrate’s 2023 winner for Best Overall Online Tax Filing Software. Means you know the price of tax prep before you begin.

How is Federal Income Tax (FIT) calculated?

ADP is an online paycheck manager which calculates payroll taxes, manages employee taxes, and facilitates entire payroll processing. You can check personal salary, retirement, savings for extra money, and investment decisions. Additionally, you can choose from Retirement Calculators & Tools, Salary Calculators, and Paycard Savings Calculator. QuickBooks Payroll from Intuit is a cloud-based payroll service that you can use stand-alone or in integration with QuickBooks Online.

- In addition to withholding federal and state taxes, part of your gross income might also have to contribute to deductions.

- This caused Intuit Canada to stop offering QuickTax Pro50 and Pro100 products, and they now offer QuickTax 20 as an alternative.

- The tool calculates overtime pay using time and a half.

- Please keep in mind third parties may use a different credit score when evaluating your creditworthiness.

Insurance coverage, which may vary with different states, depend on the type of business, number of employees, and other factors. The FUTA tax rate is 6%, but most employers can take a FUTA credit of 5.4%, resulting in 0.6%. Supporting Identification Documents must be original or copies certified by the issuing agency. Original supporting documentation for dependents must be included in the application. Deductions are used to lower your taxable income, while tax credits are subtracted from the amount you owe. Payroll Payroll services and support to keep you compliant.

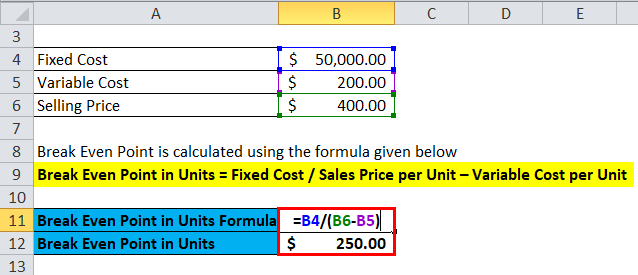

Step 2: How to determine and enter monthly expenses

Plans & Pricing Find which plan best suits your business. Manage e-commerce New Grow your product-based business with an all-in-one-platform. Manage e-commerce Grow your product-based business with an all-in-one-platform. Advanced accounting Scale smarter with profitability insights.

- Get a personalized spending plan and track your monthly spending automatically with our award-winning app.

- In November 2005, Intuit acquired MyCorporation.com, an online business document filing service, for $20 million from original founders Philip and Nellie Akalp.

- Budgets can also help you pay down debt and build your savings — if you build those into your plan.

- The annual amount is your gross pay for the whole year.

For example, some money managers use Intuit’s intrinsic value based on its ongoing forecasts of Intuit’s financial statements. In contrast, other private, professional wealth advisors use a multiplier approach by looking to relative value analysis against Intuit’s closest peers. When choosing an evaluation method for Intuit Inc, ensure it is appropriate for the firm given its current financial situation and market classification. If more than one evaluation category is relevant, we suggest using both methods to arrive at a better estimate. But if you are not already in the QuickBooks ecosystem, you can consider the best payroll apps available in the market before making a final choice. If you have budget constraints, you can also look at the free payroll apps available.

Automated Tax and Forms

It is done using both, our quantitative analysis of the company fundamentals as well as its intrinsic market price estimation to project the real value. ☞ Check Timecamp & QuickBooks integration to track time for payroll directly in QuickBooks and automate payroll process. There is not much to do when you are late with payroll. You should apologize to your employees and make intuit wage calculator sure not to make any further mistakes while you rush through your payroll. Underpaying andoverpayingcan be detrimental not only to your business finances but also to your relationship with the employees. Especially, if you hire many people on different contracts or if you own a small business and do not have the HR and accounting department to take care of payroll issues.

The result should be an estimate of the salaried employee’s paycheck that pay period. The result should be an estimate of the hourly employee’s paycheck that pay period. As you add basic staff information into QuickBooks, you have the option to input your employees’ email addresses. This allows the system to send them a link to view their pay stubs and W-2s via QuickBooks Workforce, the provider’s self-service online portal. There’s even an option for the system to invite employees to track and record their work hours via QuickBooks Time.

Lascia un commento